Another example of using these two functions together is in modeling rent growth with rent growth assumptions that change each year. In modeling your market rent, you would use an INDEX() + MATCH() to find the user-defined rent growth value for each year and apply that to your market rent. It’s also easier to use because you don’t need to create formulas https://www.bookstime.com/ to perform calculations and process data. Excel requires users to have in-depth knowledge of formulas and even a little bit of programming to create automations. The general journal (GJ) and general ledger (GL) are the two most important records in accounting. All transactions in a business are recorded in the GJ and summarized in the GL.

Multifamily Development Model

We’re an institutionally backed, data-infused real estate operator that currently invests in STNL retail real estate assets, multi-tenant retail assets, and land around the United States. We rely on large swaths of data, together with speed and efficiency to quickly and accurately identify and underwrite assets as they come to market. To make that possible, we’ve built our own proprietary, non-Excel based underwriting application. This commission tracker allows you to pull gross commission income by any twelve month period and project your cash flow by looking at pending and closed deals. The model can also report the capital account balance for any partner as of any date, so long as the actual data has been properly recorded in the model. The main challenge of inventory accounting is determining the cost of inventory on hand at the end of the year versus the cost of inventory sold during the year, also known as cost of goods sold (COGS).

Best Overall for Property Managers

Depending on how much you want to invest, most real estate agents turn to one of the following options for their accounts. Now that you know the importance of strong real estate accounting and what to expect regarding trackable financial information, it’s time to take a closer look at best practices. However, if you’re looking for a versatile, customizable solution that puts you in the driver’s seat of your property accounting, then property management software, like DoorLoop, may be the best option. In conclusion, spreadsheets can be a helpful and cost-effective tool for managing your property accounting needs. This can lead to unauthorized access to sensitive financial data or accidental changes to your rental property bookkeeping. At this point, you should know everything about tracking your property accounting with spreadsheets.

What to Include in Your Real Estate Agent Expenses Spreadsheet

Recording these fees in your spreadsheet helps you evaluate the financial performance of your rental property and compare the costs of different property managers. Now that you have a basic proficiency using various Excel functions and features necessary for real estate, it’s now time to turn your attention to mastering real estate financial modeling. A well-built real estate financial modeling is built on the framework of Inputs, Calculation Modules, and Outputs. Those inputs then run through calculation modules (e.g. operating cash flow module).

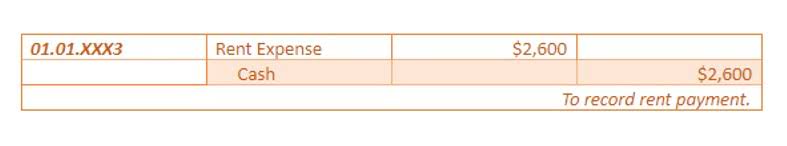

- You can use the amortization table to record monthly interest expenses and update loans payable in the books.

- So for instance, if you have a list of 10,000 values and you’d like to know what the maximum value is in the list, you’d use the MAX() function.

- Excel just happens to be the most common medium for modeling real estate cash flows, but it’s not the only medium nor even the best medium.

- Learn the basics of good property accounting, from important terms, metrics, and formulas to best practices and mistakes to avoid.

- You can then analyze which charges need to be looked after and which need to be managed more effectively.

- While this doesn’t require complete knowledge of everything there is to know about financial management, it does require a willingness to learn, make changes, and stay on top of essential accounting tasks.

Tenant Sales and Occupancy Cost in Retail Underwriting (UPDATED JUNE

- Expense reports let you view all of your expenses in one cohesive document.

- These additional sources contribute to your overall cash flow and must be accounted for in your financial statements.

- As you progress in your real estate career, you will need to become more sophisticated in your real estate accounting or hire someone to do it for you.

- An Excel expense sheet designed as a real estate expense tracker can be a helpful tool for realtors.

- The SUMIF() and SUMPRODUCT() functions are companions to the SUM() function, providing greater flexibility to sum and multiply values.

Add an unlimited number of free sub-users to your account, such as family members, employees, accountants, and tax professionals. To use this spreadsheet in Excel, download the file from Google Sheets in .csv or .xlsx format and then open the file in Excel. Therefore, for an investor, it is important to have one confined document that will add structure to this management. Now let’s suppose you are an investor who has purchased an apartment complex to rent it out and maintain a stable income stream on an equal period basis. A good P&L statement also serves as a road map for opportunities to improve income, minimize expenditures, and maximize net operating income (NOI).

- Click the ‘Apartment’ link at the top of the library grid and the library will automatically sort by apartment models.

- Understanding the division between bookkeeping and accounting gives you more confidence and helps you know when to delegate tasks to other professionals in these crucial areas.

- You can use this information to make tax payments and prepare the business owner for a potential audit.

- Implement data validation to restrict the types of data that can be entered into specific cells.

- You should also consider depreciation expenses, current market values, and any planned down payments you plan to make for new property investments.

- While information is fresh and using the app, they can add notes about all interactions with clients, send invoices and invite clients to pay instantly using third-party integrations like Stripe.

What is the best accounting software for real estate agents?

For example, QuickBooks teaches its accountants to identify common bookkeeping issues, visualize their clients’ business performance and compare it with industry peers to advise on areas of improvement. With more accurate accounting practices and guidance on how to compete in the real estate industry, you are set up for business health and growth. Real estate agents that need a full-feature but easy-to-use accounting software that’s accessible for their use even while showing homes or meeting with clients should consider Xero. Capitalization rate is the annual rate of return that a rental property generates or is expected to generate.

- You can customize the list of categories according to investors’ interests.

- Here’s an example of the real estate balance sheet for the same single-family rental property.

- Other features you may want to consider include whether the software has a mobile app, how good its customer service is and how well it does with accounts receivable (A/R) and financial reporting.

- A great real estate expense spreadsheet will have a dashboard that allows you to analyze your expenses in a visual format.

- Simply enter some information to view projected key return on investment (ROI) metrics, including cash flow, cash-on-cash return, net operating income, and cap rate.

A good rental property chart of accounts also serves as a tool to help you make better future investment decisions. Because real estate markets historically move in cycles, prudent investors focus primarily on cash flow when analyzing potential real estate investments instead of trying to time the market. That’s because sellers sometimes omit key information such as management fees or the costs of funding a CapEx account to make the property’s operating expenses look lower than they really are. Begin by choosing a spreadsheet software program such as Google Sheets, Microsoft Excel, LibreOffice Calc, or Open Office Calc. Doing a rental property analysis on a spreadsheet makes updating much easier when you are analyzing multiple options before choosing the best property to invest in.

Follow for More Advice for Real Estate Agents and Your Real Estate Business

Its $10 per month Sage Accounting Start plan offers the ability to track expenses, create and send invoices and reconcile bank accounts. Its Sage Accounting $7.50 per month plan (current promotion) includes receipt capture tools (free for three months), real estate accounting unlimited users, quotes and estimates, cash flow forecasting and invoice management tools. Its paid plans add features, such as the ability to invite more users, pay bills, assign custom roles, manage timesheets and set up automation rules.